Find out what business insurance covers. In this guide, we list the different risks small businesses face and the types of policies to protect them

Business insurance plays an important role in providing financial protection when unexpected events threaten to disrupt your operations. Having the right coverage is vital in helping your business recover faster.

But what does business insurance cover exactly?

This is one of the questions Insurance Business will answer in this client education article. We will give you a rundown of the different risks business insurance covers. We also talked to an industry expert who will explain the importance of getting the right policies.

If you’re a small business owner trying to work out the right coverage for your unique needs, this guide can help. Read on and learn more about how business insurance can protect one of your biggest assets.

What types of risk does business insurance cover?

As a business owner, you face a lot of risks in the day-to-day management of your operations. These risks can involve your employees, the business’ property, and third parties such as clients and customers. Here are the most common risks that business insurance covers:

1. Business liability

Unexpected accidents and mistakes can happen because of your business activities. These incidents can easily lead to costly lawsuits.

Business insurance covers your legal expenses if you or your business is sued. It also pays for settlements costs if your business is found to be liable for third-party injuries and property damage. Some forms of business liability insurance provide coverage for cases of copyright infringement and personal injury such as libel and slander. That’s if these incidents are unintentional.

Learn more about the different types of liability insurance coverage your business needs in this guide.

2. Property damage

Any damage to your business’ property can prove costly to your operations. Commercial property insurance pays for the cost to repair or replace your business’ physical assets that have been damaged by unforeseen disasters. This form of business insurance covers:

- the property or building your business operates in

- any equipment and technology your business uses

- inventory of products and materials your business stores and sells

3. Employee-related risks

This type of risk comes in several forms:

- a disgruntled former employee may sue your business for unfair employment practices

- one of your workers may steal company property

- a staff member may suffer an illness or injury while doing their job

These instances can be covered by the right business insurance.

Employment practices liability insurance, for instance, covers the legal costs of employment-related lawsuits. Business crime insurance covers incidents of employee theft and other criminal acts. Work-related injuries and illnesses are covered by workers’ compensation insurance, a legally required form of business insurance.

4. Business interruption

Unexpected events can force your business to shut down operations. This can put many small enterprises in a dire financial situation. If an insured peril causes your business to temporarily halt operations, business interruption insurance can cover your operating costs. These include:

- employee salaries

- lost income

- mortgage or rent on commercial space

- business loan repayments

- taxes

This type of business insurance may also cover additional expenses related to the closure. These include the cost of setting up a temporary location or training employees to use new equipment.

5. Cyber risks

The rapid pace of digital transformation has given rise to more complex and dangerous cybersecurity risks. Small businesses have become an easy target for cybercriminals because of the amount of sensitive information they handle and the limited resources they can put for cyber defense.

Cyber insurance is a form of business insurance that covers financial losses resulting from cyberattacks. These include:

- the cost of responding to a data breach

- the cost of restoring and recovering lost or damaged data

- lost income resulting from business interruption

- ransomware attack payments

- risk assessment of future cyberattacks

- legal and settlement expenses from lawsuits from a cyber incident

- regulatory penalties and fines

Learn more about how business insurance can help you navigate challenging times in this guide.

What types of business insurance do you need as a small business owner?

Your business faces its own set of risks that may be different from those of other enterprises. Because of this, there isn’t a single business insurance policy that can cover every need.

Business insurance is a broad type of coverage that protects businesses financially when unexpected accidents and disasters strike. Business insurance comes in many forms. The key to finding the right coverage is evaluating certain aspects of your business, including its size, scope, and location.

Here’s a list of some of the most important types of business insurance that small enterprises must consider.

1. General liability insurance

Although not legally required, general liability insurance is one of the most essential policies to have because of the level of protection it provides.

“General liability insurance provides protection from liability lawsuits resulting from your business activities,” said Rachel Kallmyer, industry lead at Travelers. “[These include] a customer slipping on a wet floor, a defective product causing damage to a client’s property, or claims that the products or services you provided caused injury. It can also protect you from libel, slander, and certain legal claims related to advertising.”

General liability insurance covers the legal and settlement costs if a third party decides to sue. Some policies may also pay for medical expenses for injuries that happen within your business premises. This is regardless of whether you are at fault or if a lawsuit has been filed.

Learn more about how general liability insurance works in this guide.

2. Commercial property insurance

Commercial property insurance helps minimize the financial impact if unforeseen disasters damage your business’ on-site physical assets.

The property coverage portion of a [business owner’s policy] helps protect business property you own, lease, or rent, including your buildings, equipment, furniture, and inventory,” Kallmyer said. “It helps cover repair or replacement costs of stolen, damaged or destroyed property, including property that isn’t yours but was in your care.

“It can also cover loss of income and covered expenses like rent, payroll, and other financial responsibilities while your property is being repaired or replaced after a fire or other covered losses.”

Commercial property insurance is often bundled with general liability insurance in a business owner’s policy (BOP), which is a form of small business insurance. Some BOPs also include coverage for business interruption.

3. Worker’s compensation insurance

Almost all states in the US require businesses to take out workers’ compensation insurance. This type of business insurance covers the cost of medical care and a portion of lost income of employees who become injured or ill while doing their jobs.

The type and level of protection vary depending on the insurance provider, but generally, workers’ compensation covers:

- hospital and medical expenses, including doctor visits, medical tests and diagnostics, surgeries, and prescription medication

- part of lost income if an employee needs to take time off work because of illness or injury

- ongoing care costs if an employee requires extended medical care, including rehabilitation costs

- legal and settlement expenses if your business gets sued

- full or partial disability benefits if a job-related accident causes a worker to become disabled

- death benefit, including funeral and burial expenses and financial support for the worker’s beneficiaries

Workers’ compensation laws vary by state. If you want to know how this form of coverage works in your region, you can check out this comprehensive guide to workers’ compensation insurance.

4. Commercial auto insurance

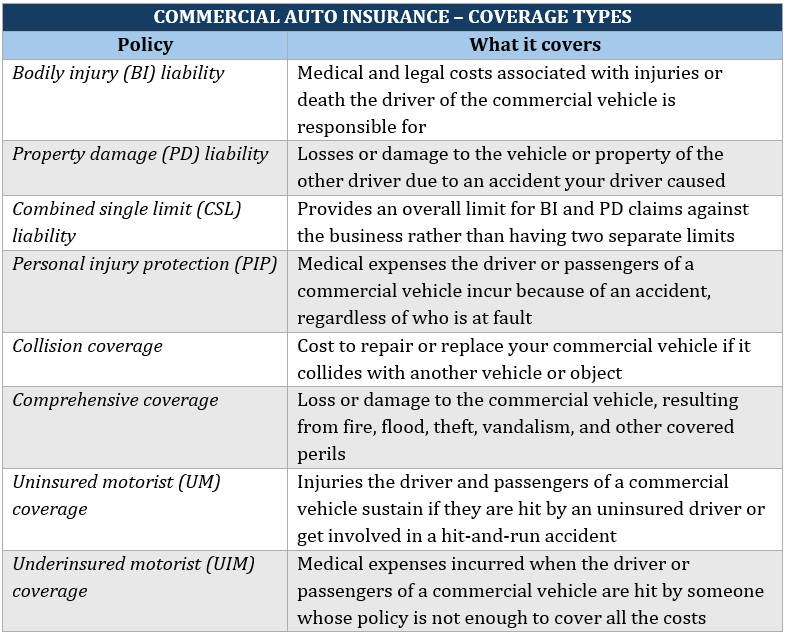

Commercial vehicle insurance is another type of business insurance that is legally required in nearly all states. This form of coverage works similarly to private car insurance, but with one major difference – the policy covers vehicles used for business activities.

The table sums up what this form of business insurance covers:

5. Cyber insurance

Cyber insurance protects businesses against financial losses resulting from cyberattacks. This type of business insurance provides two types of coverage:

- first-party coverage: pays for the financial losses your business incurs because of a cyber incident

- third-party coverage: provides financial protection against lawsuits filed by third parties for damages caused by a cyberattack on the business

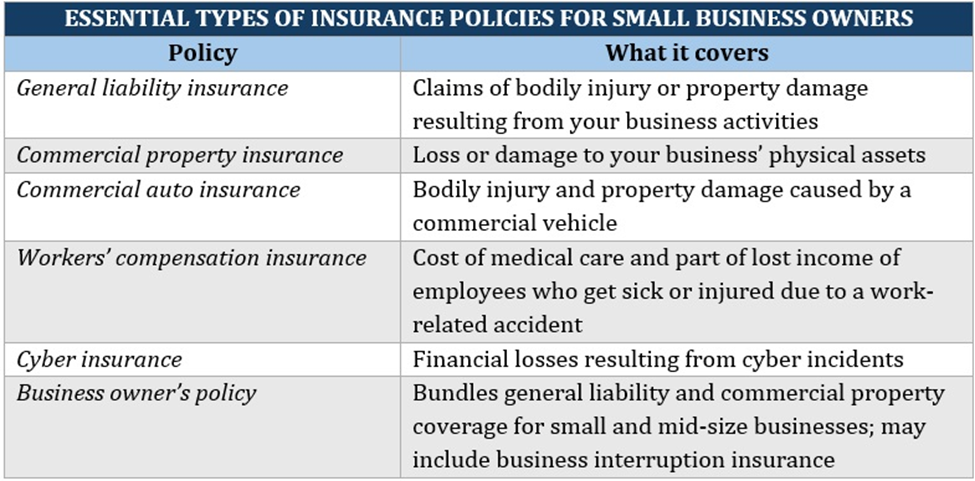

Here’s a summary of what the different types of business insurance cover:

Check out the complete list of coverage SMEs need in this guide to insurance for small businesses.

What should small enterprises consider when choosing business insurance?

Different businesses have varying needs. That’s why it’s important for small businesses to shop around and compare options to make sure they get the best possible protection. Among the factors that you should consider when choosing the right business insurance policies are:

Coverage options

Many policies look similar across insurers in terms of what is and isn’t covered. Remember to ask the insurers if you can add or extend coverage to suit your business needs.

Policy limits

The limits of each business insurance policy must cover the full cost of the coverage you require.

Premiums and deductibles

It’s tempting to choose a policy with the cheapest premiums. This, however, could backfire and cost you more in the long run, especially if your policy isn’t enough to cover the full cost of the damage.

Choose policies with premiums and deductibles that offer the best value for the amount of coverage and level of risk facing your business. This guide on how much small business insurance costs can give you an idea of the premiums you need to pay for each policy.

Claims reporting

Make sure that you can navigate the claims process easily to minimize financial losses and disruptions to your operations. The process is often laid out in the product disclosure statement of your policy document.

Company reputation

Look for business insurance providers with a good track record for customer satisfaction and fair business practices.

Financial stability

Go with an insurer that’s in good shape financially to cover claims that may arise.

It would help small business owners to get a policy that can be customized to match their business’ unique requirements.

“Recommended coverage often depends on the type of business you have and the risk protection your business needs to stay healthy and whole,” Kallmyer said. “Coverage must be customizable to fit the needs of your business. When customizing a policy, your agent should take your location, business assets, industry risks, and your personal risk tolerance into account.

“As your business grows, offers new products or services, buys new equipment, or develops new revenue streams, you may also take on new risks. It's a good idea to review your policies whenever something significant changes, and at least once per year, to identify new areas of risk and ensure your coverage is adequate.”

Why is it important to have business insurance?

In your day-to-day operations, your business may face situations that can adversely impact your ability to earn profit. Mistakes can result in costly lawsuits, while accidents and calamities can eat into your revenue. Having the right business insurance policies can help protect your business financially when unforeseen disasters strike.

“At the most basic level, insurance helps manage the risk of loss for a small business,” Kallmyer said.

“It can provide protection from the financial impact of unexpected events, such as an employee injury, a lawsuit, a natural disaster, a fire, theft of property, or an automobile accident. Insurance can help you recover from events that would otherwise threaten your company and reduce the likelihood of staying in business.”

Getting proper coverage, however, is just one aspect of minimizing your business’ losses. Pairing the right business insurance with sound risk management strategies is often the best way to protect your assets and finances.

If you’re searching for an insurer to provide the best coverage for your business, our Best in Insurance Special Reports page is the place to go. The companies featured in our special reports have been nominated by their peers and vetted by our panel of experts as trusted and dependable market leaders. By partnering with these insurers, you can be sure that your business is in good hands.